Friday afternoon we got a press release from Air Wisconsin notifying the market that American will terminate its CPA with the company effective April 3rd. This was not entirely a surprise following the 8-K filed in December that detailed the 4th Amendment to the CPA entered on November 27th. The Amendment allowed for American to terminate the deal for “convenience purposes” and provided for a one time payment on the amendment date to Air Wisconsin and one more payment when the wind down is complete.

I don’t have a ballpark estimate of what the size of these payments are and we won’t find out until the remaining Qs and K are filed, hopefully sometime in February. Clearly the negotiations with American and the resulting removal of planes from the CPA triggers goodwill tests and the accounting will have to be adjusted. I will take a guess and say that these payments combined are likely to be around $5M.

American had previously communicated with the market that they expected to phase out 50 seat CRJ 200 from their fleet by 2030. However, with the rest of the industry making that transition already, they decided they had to follow suit much earlier and move towards larger, more cost-effective planes. This clearly leaves Air Wisconsin in a situation where they will be highly unlikely to find suitable employment for all of the 60 CRJ200s they own.

The press release mentions they are pivoting towards offering EAS service under a model where they receive govt subsidies for providing service from tiny, rural airports to larger hub airports. In addition, they mention they are expanding their charter service which is seeing increasing demand from collegiate teams due to expanded travel requirements necessitated by the break up of regional sports athletic conferences which have created huge geographic dispersion withing the larger conferences.

The above press release mentions that charter demand has grown “significantly”. I am not sure what that means in terms of how many planes can be used in these charters. Clearly football teams are too large to use CRJ200s so this leaved basketball, volleyball, lacrosse etc teams that can use this service. I am not sure how big this market is and what the competition is in this space. Clearly flying charter vs. commercial for teams of 20 people or so is much more convenient and less tiresome for the students vs. commercial travel with long wait times, security, luggage etc. There are probably about 30-40 Universities that have moved conferences (eg. Pac-10) to larger conferences that have teams all over the country now. Many of these Universities likely have the means to pay for charter, especially discounted rates offered by Air Wisconsin that owns fully depreciated planes and has an experienced crew of commercial pilots and FAs to provide great service. I have spoken to a representative of the company who told me the margins in this nascent business are better than the American CPA under which American had all the leverage and squeezed the regional airline pretty hard. I would love to believe they can over time have a 20-30 or more planes flying charter, but I am not sure how realistic this guess is yet. We won’t find out more from the company how much business they have garnered in this space until the filings.

A quick examination of this market yields the following competitors in the space.

Many of these companies are brokers mostly so they may likely be partners and/or competitors. Many utilize larger aircraft and smaller jets like CRJ200, along with smaller luxury jets. There seems to be enough of a market here to make a real difference for Air Wisconsin.

Other potential charter examples include on with Bark Air to fly people with their pets.

Again I not sure what the market size is or can be for these types of services.

Moving on to EAS service — From my understanding, the size of this market is large enough in the US but only a handful of these contracts come up every year. So, at this point Air Wisconsin has applied for this handful, but it will take many years I am guessing to gain a large foothold in this business. Air Wisconsin is very competitive in this space given their experienced flight crews and fully paid planes.

https://www.regulations.gov/document/DOT-OST-2003-14492-0134

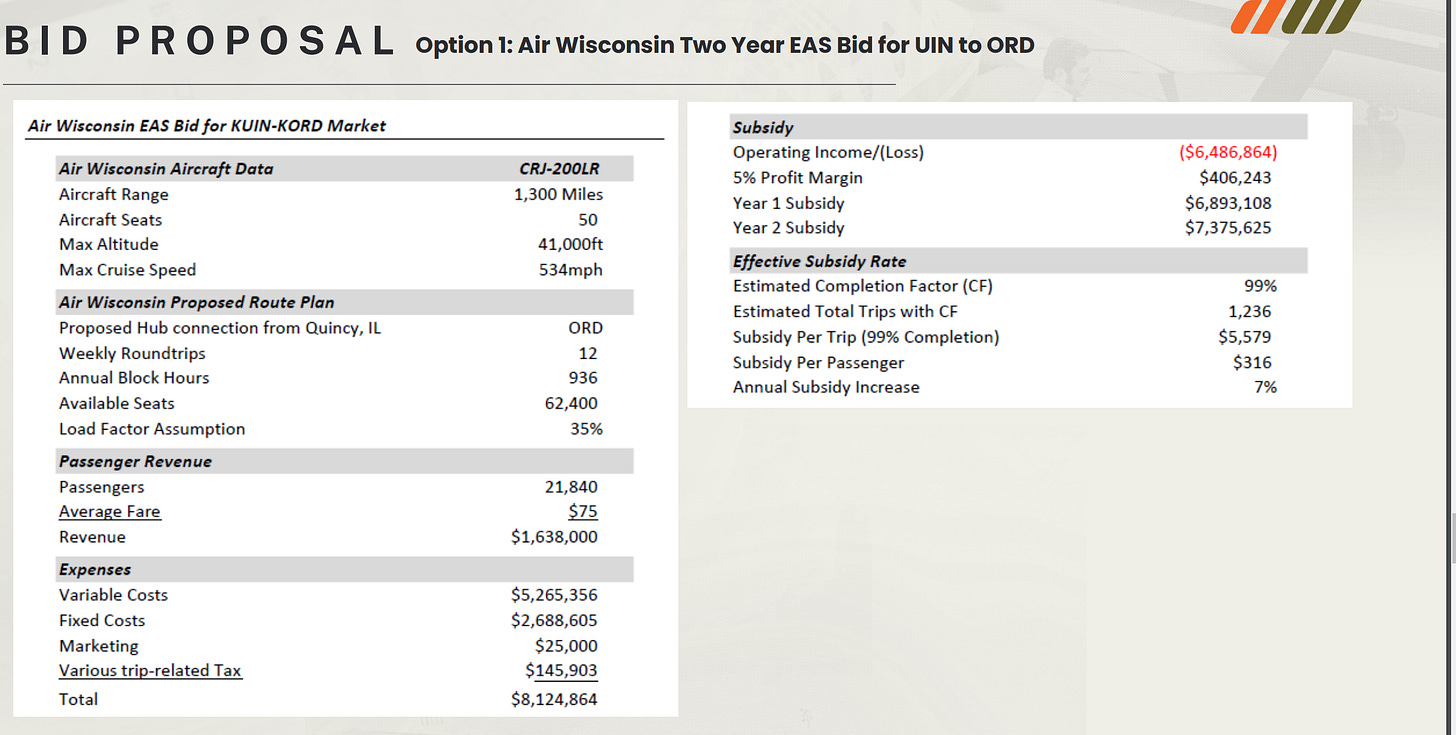

The above link is to a recent proposal they made.

As we can see they are asking for a subsidy that provides them with a narrow 5% profit margin. Of course, EBITDA margins are much higher as the fixed costs include a hefty amount of non-cash D&A. This would be a great way to extend the life of the CRJ200s but again this is not likely to keep more than 5 planes or so active right away at best. Meanwhile, the company is continuing its codeshare and interline agreement with American as the CPA termination was not an acrimonious split based on my understanding. Indeed, in the bid proposal above Air Wisconsin provides some stats on its customer service based on time arrivals and such seen below.

Clearly, I would guess American was happy with 99.9% completion rate in the last year.

So where does this leave us as shareholders?

LATEST DATA FROM 12/31/23

The company had $113M in cash and a $6M income tax refund due based on restating 2022 due to United dispute that led to losses that year at the end 2023.

It paid off all its aircraft debt leaving it debt free. In 2024 it paid $10M in cash and issued 16.5M common shares to retire all the convertible pfd stock. If we assume they used the $6M in tax refunds and about $5M in interest on the cash pile to pay the $10M that leaves the company with still about $112M in net cash plus any free cash flow they generated operating for American in 2024. My guess is they probably earned about $10M in 2024 operationally. They had a small working cap deficit at the end 2023 so zeroing that WC deficit basically leaves us with ~$110M in net cash. In addition, they own 62 planes that are now debt free along with some spare engines.

What might the CRJ 200 planes be worth if they sell a number of them? I am estimating the average value of each of these planes if they are scrapped/sold fire sale to be about $1M each. Some of the ones in better shape with less flying hours are likely worth considerably more. They leased one of them out as per the 10-K for $2M for 3 years.

As we can see above, they say they may seek to enter into similar leases going forward. This lease would provide much higher value for planes they can’t utilize going forward in charter or EAS service.

They clearly are not looking to liquidate though and plan on operating profitable at some level going forward based on their continued efforts to hire flight attendants and other personnel that have been posted on Twitter as recently as 5 days ago. If we are to make a conservative guess and say they will only utilize 30 planes going forward, the sale/scrapping of the other 30 will generate about $30M in cash. If they can operate on a break-even basis over the next year as they ramp up the new businesses, we would have $145M in net cash ($5M from interest added over next year) and 30 planes in service. If we assume they burn $15M as their new businesses scale would have $130M in cash at year 2025 and 30 planes. (It is likely we see some burn as the company won’t be able to align its workforce costs lower in the short term. However, the American termination payments should cover some of these costs).

The company has 58.5M shares outstanding at this point so cash per share would be $2.22 - $2.47 under the aforementioned scenarios plus the value of the new operations.

This investment has clearly not worked the way I had hoped, and the United arbitration loss has proved to be a tough pill to swallow for the company. I am under no illusion that my investment is a PASSIVE MINORITY investment in basically a PRIVATE company at this point. However, the ownership team led by top not capital allocators, whose incentives fully align with common holders, should over time find the best value for the remaining assets which include a fully paid fleet of planes (albeit old) and a fully functional operational airline.

Thanks for the update. I owned this stock years ago when it was at 50 cents and was fortunate to sell in the $2 area. Many investors have lived and written this story up as a value play only to get stuck in a value trap. I disagree that a) that they are good capital allocatorsb) good management and c) aligned accept that do own stock. The company should have paid out a big chunk of cash over the years. I think they will go dark and take the company private for Pennie’s on the dollar to do the final screw job on minority investors. Good luck and again thank you for the note.

Thanks for the post, DO EM GO. Hopefully the specter of another Luigi Mangione can keep management from a scummy take-under that screws minority shareholders.