New Position in TRIP

I have followed and been in and out (thankfully profitably) of TRIP a few times. Following its earnings release the stock has collapsed and I have bought a sizable position at $9.80 on average. The earnings miss was further evidence that its core Hotel Metasearch business is shrinking faster than “hoped” for. Meanwhile its two other units, Experiences and restaurant booking platform TheFork, are still growing nicely with the former slowing down on growth unfortunately. Certainly, the results were disappointing but as always investment is the marriage between value and Price. The value here may not be growing as hoped but it is STILL growing but the price is basically saying value is shrinking and FAST. This is certainly not true and herein lies the opportunity if you are not worried about buying the stock and waking up being down 10% in a week and possible a month or two. So why jump in now? I am not sure where the stock will be in the next few weeks so you have to take a stand.

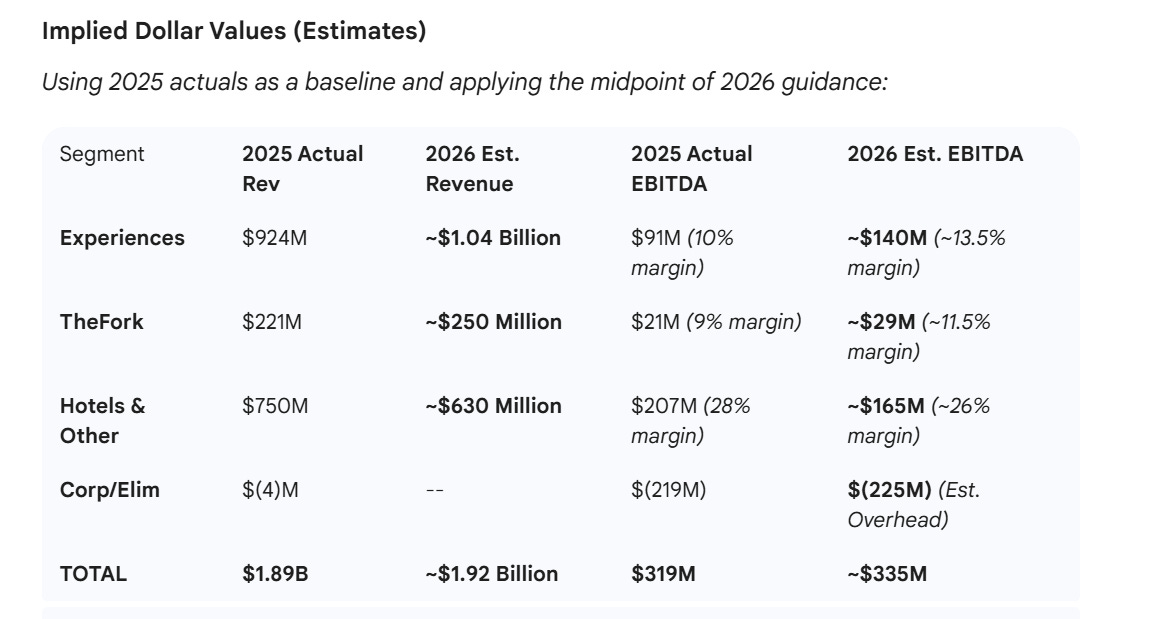

The key to my aggressive purchase is the fact they made it clear that they will sell TheFork business. The Fork is the leading restaurant booking app in a highly fragmented and undeveloped booking market in Europe. They clearly either got inbound interest for the business or Starboard, who owns 9.9%, pushed them to sell the business and allocate capital to either buybacks or some other form of capital return. The clearly said on the call that the business does not have huge synergies with the rest of the business and is likely more valuable in bigger hands (like a Booking.com, Expedia, Visa , Doordash etc.) where it can scale faster. The business did $221M in revenues in 2025 at 9% EBITDA margins which are nowhere near steady state mature margins. The company guided to revenues of $250M in 2026 and 11-12% EBITDA margins.

Here is the rough guidance they gave on the call for all the businesses:

So basically, we have a $250M revenue business growing mid-teens with a sizable runway. What is the likely price for The Fork? Well the last direct comp we have is Resy which sold for 20x revenues but it only had $10M and Amex likely scaled very quickly. Opentable sold for 13x revenues but that was way too long to consider it a relevant comp. The most relevant comp IMO was DoorDash buying SevenRooms for $1.2B or which was done at a roughly 10x revenue multiple. Seven rooms was growing 30-40% so that justified that multiple. So what is fair for THe Fork? I think a 5x revenue multiple is fair which would bring in $1.25B. Let’s assume they only get 4x so $1B.

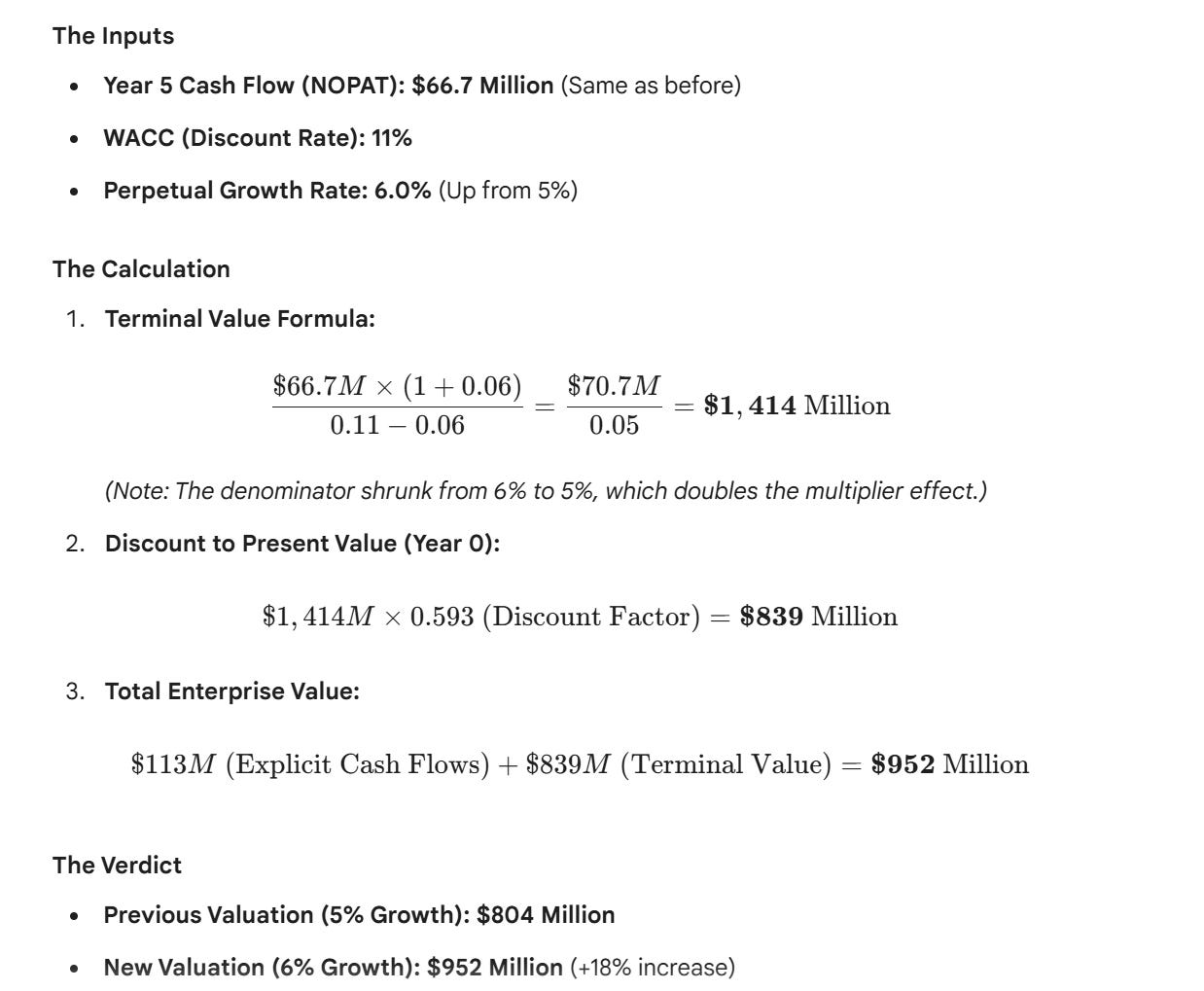

Let’s do a very basic DCF to check this number. I normally hate using DCF’s because of the garbage in, garbage out issue as I have low confidence I can estimate reasonable numbers in more than a year or two out but let’s be conservative and do it under the following assumptions. 15% growth top line for 5 years and 6% thereafter with EBITDA margins scaling linearly to 20% by year 5%. WACC is 11% which i think is fair. Based on that Gemini quickly returns the following valuation.

So as a sanity check we get to around $1B. It is logical to think the business can scale much faster in the arms a larger strategic buyer like Booking.com. So they have room to pay these prices and still get a great deal and of course they have much lower cost of capital.

I think the sale of The Fork will be a huge value driver for the company which right now is being valued at an EV less than $1.5B. For basically $600M if believe they get $900M for The Fork you get the melting Ice cube hotel business and the largest experiences marketplace in outside of Asia where Super App Klook is arguably bigger but it is not as pure a comp.

This is incredibly attractive price for the Experiences business which is still growing nicely, perhaps not scaling as fast as hoped for though, and which has huge strategc value to EXPE, BKNG, ABNB who are all frantically trying to build an experiences business.

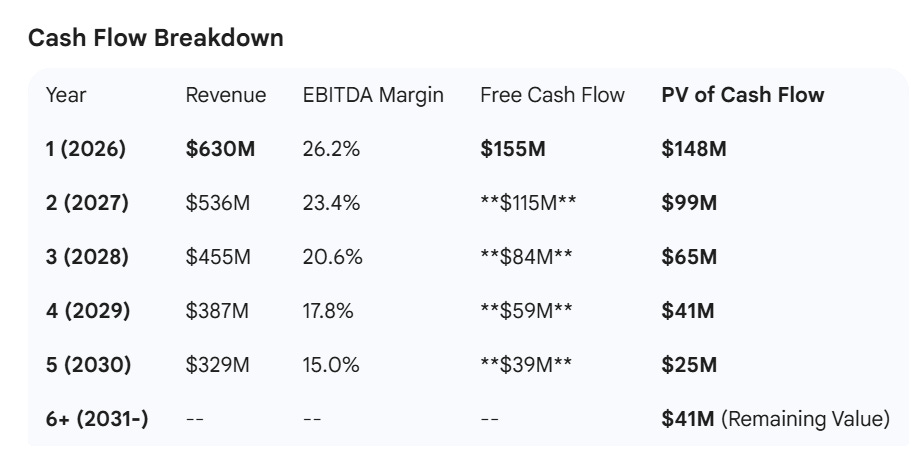

So lets value the Hotel business first. As the table shows above it is expected to do $630M in revenue this year and $165M in EBITDA. Lets assume it declines 15% a year for the next 5 years with margins declining straight line to 15% and then it exists for 3 more years declining 15% with 10% EBITDA margins.

The value under this scenario which the business disappears in 8 year is $419M.

I think this is very pessimistic and also misses the value of the company’s data. If a LLM will do your travel planning, where are they going to scrape the data to make the plans and book? the CEO mentioned on the call that LLM traffic is scraping their sites. Clearly, their data has a lot of value and a LLM will soon have to pay for it in some form. Increasingly, every business that a LLM is threatening has a data advantage that anyone turning to a LLM needs. This includes most software companies. None of these potential future revenue sharing opportunities have been laid, if they happen at all. I think TRIP’s data is very valuable although I don’t know how to value it as of now.

Lastly, we get to the experiences business. This business is expected to grow revenues 12-13% this year to roughly $1.05B and about 13-14% margins or about $140M in EBITDA. I think this business can grow low double digits for the foreseeable future given it is still far from mature where growth decelerates to slightly above nominal GDP. I think this business is early worth 2x revenue to a larger, strategic player who can scale it faster. 2x revenues is only 15x EBITDA. Again, I believe this is conservative.

Conclusion

Based on the sum of the parts we get

$2.1B for Experiences

$419M for Hotels

$900M for the Fork

This gets us to a $3.4B EV.

Clearly the market does not believe any of these numbers. It is basically saying the Fork will be sold for $500M. Hotels is worth $300M and the Experiences business is worth $700M or 0.7x revenues.

I think this is a highly asymmetric risk reward.

Would love to hear any feedback…

I just hate travel and hospitality right now

So hmm? Not now