HRBR

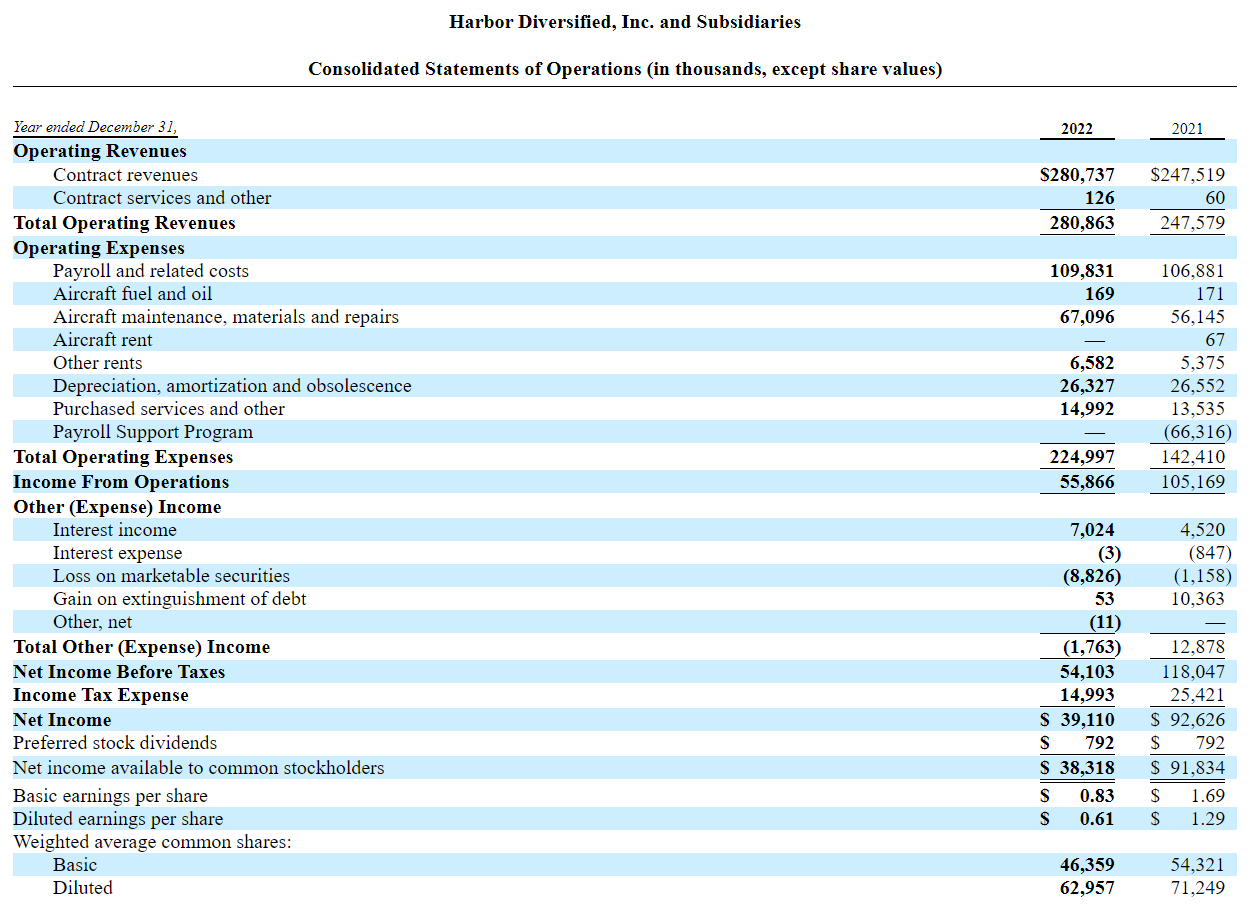

HRBR is an accidental public company run like a private company whose main virtue is its large cash hoard and the reputation of its lead director, Richard Bartlett. I read about HRBR a year or so ago but wasn’t particularly excited about it given COVID fears. However, after its recent annual report was filed, I have been aggressively purchasing the stock. The company had a spectacular, albeit unsustainable, 2021 and 2022 in terms of operating earnings. It produced $48M in earnings in 2022 and has a debt free balance sheet and an equity market cap of $130M. The real kicker is at year end the company had $182M in cash and liquid investments. This is a real Ben Graham NET-NET that has real operating earnings going forward and is run by a secretive Private Equity investor who previously took a huge position in the US Airways Bankruptcy, netting out hundreds of millions in profits for his firm Resource Holdings.

What is Harbor Diversified - HRBR?

HRBR is the holding company behind Air Wisconsin, a regional airline that has been flying Midwest flights for United Airlines for the past 5 years. It owns 64 CRJ-200 Jets with an average age of 20.3 years. These planes are ancient for airline service purposes are likely on their last legs in terms of flying commercial in the US. However, despite the old, dingy planes the company has managed to sign a new 5 Capacity Purchase Agreement (CPA) with American Airlines. The CPA began in March of this year initially for 40 of those planes with the possibility of utilizing the remainder over time as needed for a total of 60 planes.

Up to 40 CRJ-200 regional aircraft will initially be covered by the American capacity purchase agreement, subject to an implementation schedule whereby a specified number of aircraft will become available each month commencing in March 2023 and continuing through no later than October 2023. Subject to the satisfaction of certain conditions, Air Wisconsin can accelerate the implementation schedule. Air Wisconsin may also add up to 20 CRJ-200s as covered aircraft under the agreement subject to satisfying certain minimum block hour utilization thresholds (resulting in an aggregate of up to 60 covered aircraft under the agreement).

Following the new agreement, which was agreed to in August of 2022, the company has managed to utilize these planes for another 5 years. The planes have upgraded engines so they may not be “effectively” as old as their age suggests as evidenced by spending $4.1M on materials purchases in 2022.

Aircraft Maintenance, Materials and Repairs. Aircraft maintenance, materials and repairs costs increased $11.0 million, or 19.5%, to $67.1 million for the year ended December 31, 2022, compared to the year ended December 31, 2021, primarily as a result of an increase in airframe repairs and materials purchases of $5.9 million and $4.1 million.

The new agreement with American is highly redacted so we don’t know the financial terms and how they compare to the previous United Air CPA. However, the terms are the same - a fixed payment for each aircraft covered and fees for each departure and block hour flown and additional incentive payments (or rebates paid back to American) based on achieving various performance metrics. Presumably since HRBR proactively announced they were leaving the United CPA and signing with American, the new agreement has favorable terms.

HRBR - The Platform

Employees

Our continued success is partly dependent on Air Wisconsin’s ability to continue to attract and retain qualified personnel. As of December 31, 2022, Air Wisconsin employed 1,085 employees, of which 1,044 were full-time employees, 41 were part-time employees, and 813 were represented by unions.

Pilots

472 Air Line Pilots Association

189 Association of Flight Attendants

28 Transport Workers

95 International Association of Machinists and Aerospace Workers

29 International Association of Machinists and Aerospace Workers

I listed their employees to highlight that this is a full-fledged airline that has been operating profitably for years with United. Today’s airline industry is marked by severe pilot shortages, and shortages of mechanics, machinists, etc. Air Wisconsin has strong relations with its employees and indeed United tried to poach some of its pilots after Air Wisconsin announced it was moving to a CPA with American Airlines.

Why is this important? Given the very old fleet, it’s likely the company will need to wind down unless it decides to purchase/lease newer planes to continue service. In its agreement with American it states that they may purchase newer CRJ-700 planes which can then be entered into service under the CPA. Clearly this platform has value and newer planes will eventually have to be added to realize this value. At this point the company has a negative EV indicating the company may be viewed as a liquidation situation when the current agreement with American expires. IMO the stock is so thin that its trading value is not indicative in any way of its true value.

Negative Enterprise and Net Net

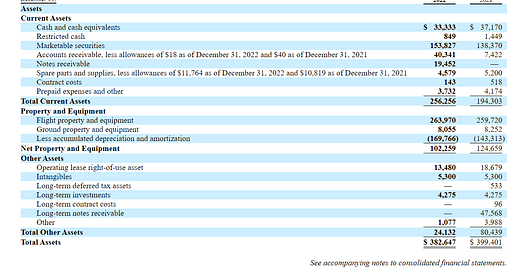

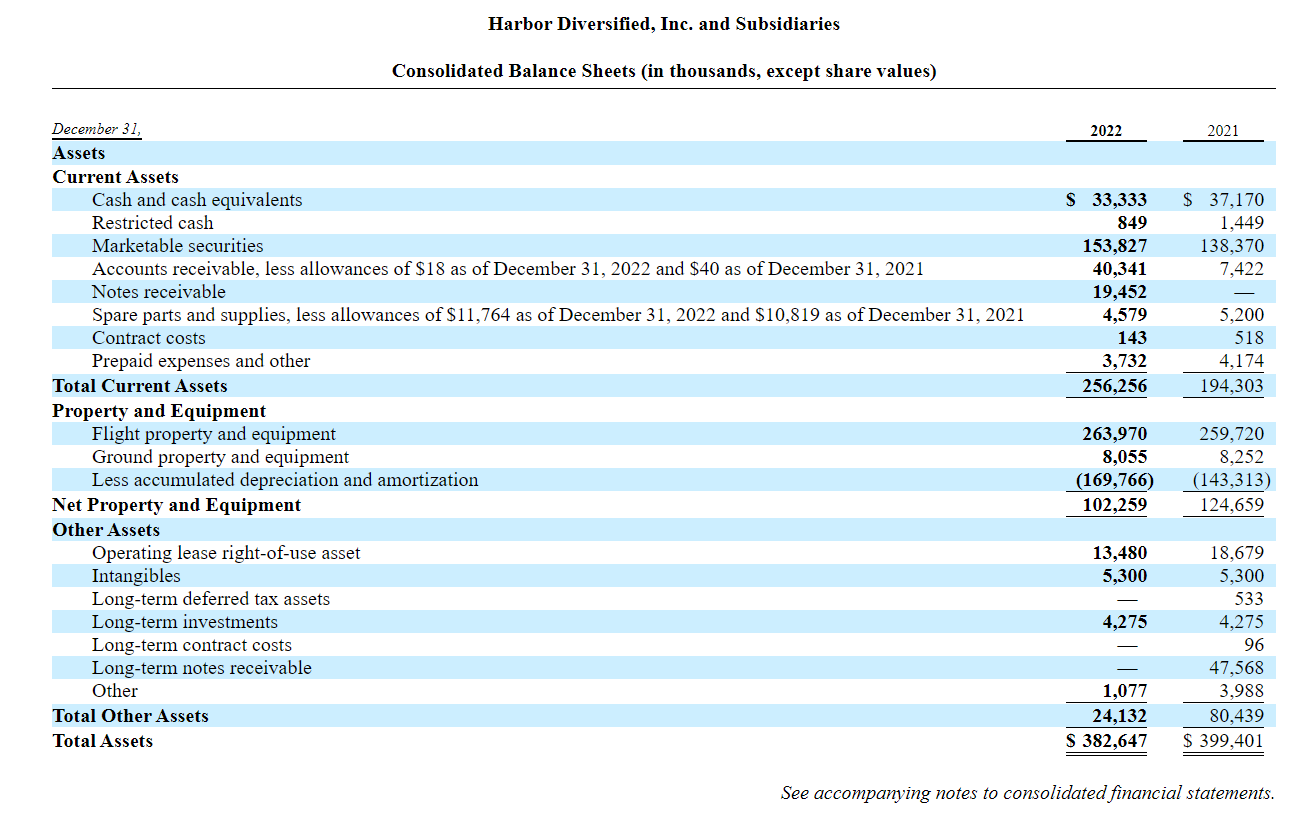

As we can see the company has $34.1M in cash and $153.8M in marketable securities at year end. (The company’s marketable securities declined by $7.7M in value last year so with the bond market rally this year it’s likely that some of that has reversed.)

We have $61.3M in debt at 4% interest with the following amortization schedule:

The Aircraft Notes are secured by Air Wisconsin’s owned aircraft and certain spare engines and spare parts. The carrying amount of the collateral exceeds the value of the debt.

The annual report states the notes are only secured by the aircraft and spare parts. I have tried to ascertain the scrap/recycling value of these planes.

https://www.flexport.com/blog/decommissioned-planes-salvage-value/

This link offers guidance for what parts from aging aircraft may fetch. Based on prices for used parts, I came up with $300K in scrap value for the 63 planes once they have been retired. As such the debt needs to be amortized to ~$18M from the current $62M to reach their scrap value. Over the next 5 years the company is operating its fleet with American it will need to amortize ~$9M per year and pay ~$8M in cumulative interest for a total of ~$53M.

The question of how to treat the debt boils down to trying to guess what the operating earnings of the 5 year deal will be worth.

The company earned $55M and $118M in pre tax income in 2022 and 2021 respectively. 2021 was aided by $66M in payroll support programs so 2022 is clearly a closer number of go forward earnings utilizing their entire fleet. Given American will initially be operating only 40 planes and hopefully ramping up to 60 over time, what is a reasonable estimate of 2023-2027 earnings? I feel a conservative estimate is $20M per year. This would be a dramatic cut from 2022 and given that HRBR chose to withdraw from United and go with American and given American agreed to amend the CPA to pay additional funds to help with increased pilot compensation in March, it seems like a fair assumption. If one makes this assumption then it is fair to value the planes in excess of the $62M in debt currently owned on them. As such we can treat the cash as free and clear.

As of March 17, 2023, the registrant had 44,811,419 shares of common stock outstanding and 4,000,000 shares of Series C Convertible Redeemable Preferred Stock outstanding.

As of December 31, 2022, Harbor had 45,219,737 shares of common stock outstanding. As of the same date, Amun LLC (“Amun”) held 20,000,000 shares of Harbor’s common stock, representing approximately 32.4% of the fully diluted shares of capital stock of Harbor, and Southshore Aircraft Holdings, LLC, through its affiliates (together, “Southshore”), held shares of Harbor’s Series C Convertible Redeemable Preferred Stock (“Series C Preferred”), which are immediately convertible into 16,500,000 shares of common stock, representing approximately 26.7% of the fully diluted shares of capital stock of Harbor (in each case assuming the full conversion of the Series C Preferred into common stock).

Since the end of the year the share count has declined by 403,318 shares to 44.8M shares. Adding the convertible shares we have a share count of 61.3M shares.

Cash/marketable securities per share at using year end cash equivalents of $188M and 61.3M shares is ~$3.06. The company is likely earning 5% on its cash and investments this year so in the past 3 months, cash likely rose by a few million if we assume the company is only breaking even during the transition period to American.

Dispute with United

A dispute exists under the United capacity purchase agreement with respect to certain recurring amounts owed to Air Wisconsin by United. In October 2022, United initiated arbitration under the United capacity purchase agreement and requested a declaration that it does not owe any of the amounts claimed by Air Wisconsin. Air Wisconsin expects that, unless the parties reach a settlement before then, the arbitration hearing will occur in July 2023 and that the arbitrators will make their award in August 2023. In December 2022 and February 2023, Air Wisconsin sent United notices of termination of the agreement. In the arbitration, United has contested Air Wisconsin’s right to terminate the agreement. In accordance with the termination provisions of the agreement, and in response to Air Wisconsin’s first termination notice, United delivered a revised wind-down schedule in January 2023. Following the delivery of that revised schedule, in February 2023, the parties agreed, in a sixth amendment to the United capacity purchase agreement, to a wind-down schedule that provides for the withdrawal of aircraft from the agreement beginning in January 2023 and continuing until June 2023, at which time all of Air Wisconsin’s remaining aircraft would be withdrawn from the agreement, and Air Wisconsin would cease flying for United.

As of December 31, 2022, the aggregate amount in dispute was approximately $47.9 million. As Air Wisconsin and United are in the early stages of arbitration, Air Wisconsin cannot, with any degree of certainty, estimate the likely outcome of the arbitration including any potential award of the disputed amounts. Air Wisconsin, however, maintains that it has a strong position and is entitled to the disputed amounts under the terms of the United capacity purchase agreement. As a result, the Company has recognized all disputed amounts through December 31, 2022.

The company is involved in an arbitration with United over funds it claims United has failed to pay following its move to American. Although I haven’t been able to find any details of the arbitration another investor on Value Investor’s Club believes some of the dispute revolves around United poaching HRBR pilots after the American move was announced thereby hurting HRBR’s ability to fly all its planes under the United CPA. I don’t know whether this is the case but the fact that United stopped paying when HRBR announced its deal with American supports a line of thinking that they were using these payments as leverage against HRBR. Furthermore United contested HRBR’s right to terminate the CPA with them indicating it wanted to possibly continue its deal with HRBR.

I have spoken to a couple of lawyers about this arbitration and they both felt this would likely be settled and a reasonable amount was in the $20-$25M range. This would add 30-40 cents per share in cash once it is settled.

Terminal Value of the Platform

As we can see from above Richard Bartlett controls the entities that hold 59.5% of the stock of the company. This is his Bio:

https://nypost.com/2006/07/14/us-airs-insiders-score-big-bankruptcy-bonuses/

https://www.nytimes.com/1986/08/10/magazine/leaving-the-law-for-wall-street-the-faster-track.html

The links above offer additional background on Bartlett who has been a long time distressed/private equity investor with great success. He has run Air Wisconsin from a strategic direction since. Using his Southshore Aircraft Holdings it appears that $125M was invested in US Airways in the BK and they exited with $475M+ in net proceeds. Nice work! (As an aside when Bartlett became a Director at US Airways, Scott Kirby who is now CEO of United Airlines was a Vice President in charge of operations so they are no stranger to one another.)

I believe that as shareholders we are in good hands with Mr. Bartlett running the show. He is clearly a sophisticated investor, and we get his expertise for free in this micro-cap that tried to stay dark (i.e. not file annual and quarterly reports in effect to operate as a private company)!

So, what do we have at current prices of $2.25 per share?

A profitable airline with a 5 year CPA in hand with American that was voluntarily signed while the company was operating a profitable CPA with United

A platform that has demonstrated strong EBITDA margins pre and post COVID (2019 EBITDA margins were 34%)

$3.05+ in net cash per share and possibly another 30-40 cents in cash from the arbitration.

Active buyback at $1M per month shrinking shares O/S and increasing NAV per share.

$62M in debt that should be easily amortized with the American CPA

Lastly and most important in my view is the optionality from Bartlett making a highly accretive acquisition/merger and creating additional value (he is incentivized to do so as his stake in the company is increasing with each share repurchase and he is not receiving material cash compensation)

in good hands of Bartlett, yeah right.

Do you still own the stock? What are your thoughts about where the company is today if you do. Thanks