HRBR finally filed their 10K last night. The most important issue for me was to discern the profitability of the new American Airlines agreement. On that front I was actually pleasantly surprised.

As we can see above the Revenue per available seat mile was up 15% over 2022. This is a blended rate because for the first 3-4 months of the year they were still flying for United. So presumably the American contract probably is 20-25% higher per ASM vs. United. It is now clear why Air Wisconsin dropped United and went with American and why United was bitter about it.

The increase in contract revenue per available seat mile during the year ended December 31, 2023, compared to the year ended December 31, 2022, was primarily attributable to increased rates in the American capacity purchase agreement, including subsequent amendments, when compared to the United capacity purchase agreement, along with the shorter average stage length.

The exact economics are not yet clear, and they will be offset by increases in wages paid to pilots and maintenance personnel, but it seems clear this is still a much more profitable agreement IMO. I believe this is clear from the fact that for the entire year of 2023, despite the transition which involved where very few planes were initially in operation for American, the company basically broke even on an operational basis.

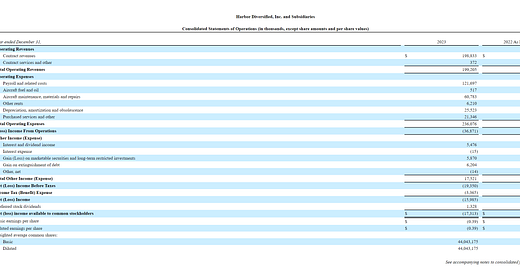

The company lost $36M last year from operations. However, $7.5M was due to legal expenses for the United arbitration and $29.5M was depreciation, amortization. The above shows $25.5M in D&A but there is an additional $4M in amortization of engine overhauls on “purchases services and other” expense line. Thes two items total $37M which indicates the company broke even on a CASH FLOW basis. Of course, the D&A expense is real over time but for a year where they on average had half of their fleet flying and had to start paying higher wages beginning in the summer, I think this is a good result. It reinforces my confidence that with 45 planes now flying for American the company is solidly profitable. It is impossible to guess with any precision, but I think they are likely in the $20M in operating profit per year ballpark. This to me indicates a viable business that is showing profits and one that over time will transition to newer planes. They talked about the need to move to newer planes as a risk and something they are actively considering. American has a number of newer CRJ700 that are not in use and leasing them to Air Wisconsin makes a lot of sense. Otherwise, Air Wisconsin is likely to slowly sell their older planes and use the capital to lease/purchase newer CRJ700s.

They have 60 planes reserved for American and managed to lease one of the 3 not reserved for American at $64K a month for two years. This is ~$750K a year. This shows there is still real value in these planes IMO. In addition, they also announced another of the unused planes will be flying charter services which adds some profitable revenues and shows possible future diversification ability.

Moving on to the balance sheet. They prepaid all their debt in December of 2023 and then in September of this year they converted all the preferred stock to common.

Cash and equivalents at year was $113M and they also had $8M in long term investments. So total cash and equivalents are $121M at year end. They had tp pay $10.2M to get rid of the pfd stock in September. They disclosed they are getting $7M in tax refund and that is Total Other Assts line. If I am right and they generates cash in first three quarters of the year of about $5M per qtr, it is likely their cash balance has gone up since year end. Netting out tax refund and pfd payment subtracts $3M and operating cash flow adds $15M or a net increase of $12M. I believe they likely have $125M in cash now. Total fully diluted shares are now 58.5M. This yields net cash per share of ~$2.12 (I am not adding anything to cash from interest over the past 9 months on the $110M or but that should have added another ~$4M in cash). In addition, the planes and engines they own I believe are worth more than their book value given what they will earn on the AA contract. $1.5M in payments for a two-year lease on one plan also clearly indicates that IMO.

The one negative is the company had to pay $10M to pfd to retire the pfd despite issuing the full 16.5M shares that were the maximum to be issued. This is not pleasant, but it cleans up the balance sheet and eliminates future interest payments and is a one-time event. At this point Rich Bartlett now only owns common shares and controls 62.5% of the shares so we are fully aligned with him IMO.

I put in a call to OTC Markets and said the company should be able to start trading again on Pink Sheet Limited market as soon as SEC indicates there will be no amendments required to the 10K filing. The guy I spoke to indicated he had no timeline on when this will happen but hopefully over the next week.

Excellent write up. Have been banging my head against the wall on this for a while as we all have - all those shares chucked away at these lower prices is crazy.

Irritating to not be able to buy at these levels, but if were a real open market it wouldn't be at these levels anyway.

Thanks for the update! Question is do they not have to also file the 10q’s from the first 2 quarters of this year before they go back on the Pink Sheets again? The 3rd quarter results are also due by Nov 14 as well.